Finance Director Explained: Role, Responsibilities, and Pathways to Success

Introduction: The Essential Role of a Finance Director

A

finance director

is a senior executive who oversees and guides the financial health of an organization. This pivotal role exists across industries, from corporations to municipal governments, and involves shaping financial strategy, ensuring compliance, and providing expert advice to top leadership. Whether you’re aspiring to this position or working with a finance director, understanding the range of responsibilities and the pathways to access or become one is crucial for organizational and career success.

[1]

Core Duties and Responsibilities of a Finance Director

The finance director’s primary responsibility is to ensure the financial stability and integrity of their organization. This is accomplished through a dynamic set of tasks that blend strategic oversight, operational management, and policy development. Key areas of responsibility include:

Source: wallpaperaccess.com

-

Strategic Financial Planning:

Finance directors formulate and direct overall financial strategy by analyzing data to forecast trends, allocate resources, and mitigate potential risks. They collaborate with other executives to ensure that all business activities align with the organization’s long-term goals.

[1]

-

Policy Development and Oversight:

Setting and maintaining accounting policies, compliance protocols, and internal controls is a core function. This ensures financial operations adhere to legal and regulatory standards.

[4]

-

Budgeting and Financial Reporting:

Finance directors oversee the creation and management of annual budgets, regular financial reviews, and the preparation of detailed financial reports for leadership and stakeholders.

[2]

-

Team Leadership:

They manage finance teams, often supervising managers, accountants, and specialized staff. Training and developing team members is part of their mandate.

[1]

-

Risk Management:

Identifying, evaluating, and minimizing financial risks is critical. Finance directors implement systems to monitor compliance and safeguard organizational assets.

[3]

-

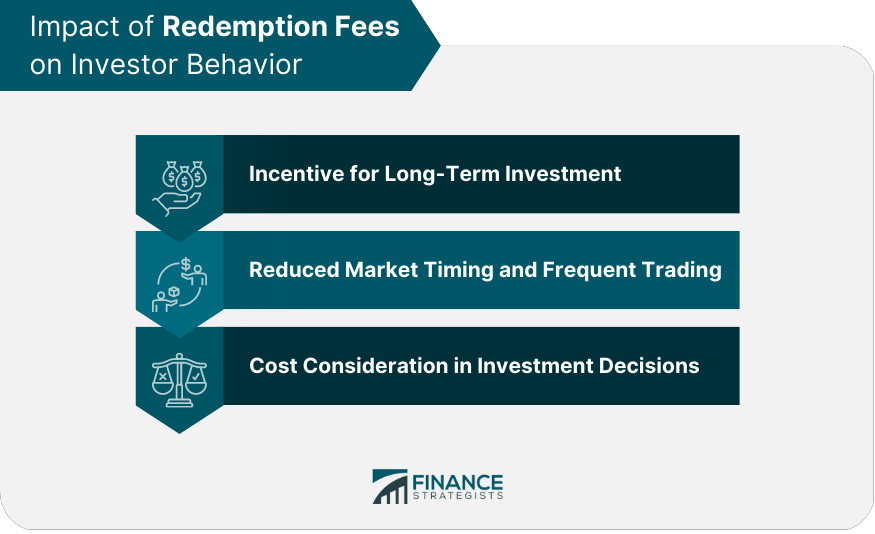

Investment and Cash Flow Management:

They evaluate investment opportunities and manage the organization’s cash flow to ensure ongoing liquidity and support for operations.

[1]

How Finance Directors Operate Within Organizations

Finance directors often serve as the highest authority in the finance department, reporting directly to the Chief Financial Officer (CFO) or, in some organizations, to the CEO or city manager. In municipal settings, the finance director may also coordinate with elected officials and oversee multiple sub-departments such as accounting, treasury, and procurement.

[4]

Smaller organizations might combine the finance director and CFO roles, while larger entities distinguish between these positions. Regardless of structure, finance directors are expected to provide clear, data-driven advice to inform high-level decisions and ensure financial sustainability.

[3]

Steps to Access or Become a Finance Director

If you are interested in working with or becoming a finance director, here are the practical steps and guidance:

-

Educational Foundation:

Most finance directors hold at least a bachelor’s degree in finance, accounting, business, or economics. Many pursue advanced degrees (such as an MBA) or relevant certifications (such as CPA or CMA) to increase their qualifications.

[2]

-

Build Relevant Experience:

Gaining progressive experience in accounting, financial reporting, or management roles is essential. Serving as a financial manager, controller, or senior accountant can provide the foundation needed for advancement.

[1]

-

Develop Key Skills:

Finance directors need strong analytical, leadership, and communication skills. Experience with budgeting software, financial modeling, and regulatory compliance is highly valued.

[3]

- Seek Out Mentorship and Networking: Building relationships with current finance directors, CFOs, or executive mentors can provide valuable insights and open doors to new opportunities. Professional associations, such as the Association for Financial Professionals, often provide networking and educational resources.

- Apply for Senior Finance Positions: When ready, candidates can search for finance director positions on reputable job boards, company careers pages, or through executive recruitment firms. Tailor your resume to highlight leadership, strategic, and compliance experience.

Practical Guidance for Organizations Seeking a Finance Director

Organizations looking to hire a finance director should:

- Define the specific needs and responsibilities for the role within their context (corporate, nonprofit, government).

- Use reputable recruiting agencies specializing in executive finance roles or post positions on established job boards such as LinkedIn, Indeed, or the Association for Financial Professionals’ career center.

- Develop a thorough interview and vetting process to assess technical expertise, leadership skills, and alignment with organizational goals.

When searching for candidates, it’s helpful to use targeted keywords like “finance director,” “senior finance manager,” or “director of financial planning.”

Source: wallpaperaccess.com

Compensation and Career Outlook

According to recent data, the average salary for finance directors in the United States is approximately $187,990 per year, with compensation varying by industry, region, and organizational size.

[2]

Many finance directors receive additional benefits, such as performance bonuses, equity, or retirement contributions. The role is considered both prestigious and demanding, with strong job growth projected, especially as organizations place increased emphasis on financial stewardship.

Challenges and Alternative Approaches

Finance directors often face challenges such as balancing organizational priorities with regulatory demands, managing cross-functional teams, and adapting to changing technology. Staying current with best practices and regulatory updates is critical. Some organizations may choose to split responsibilities between a finance director and a controller or engage external financial consultants to supplement in-house expertise.

Accessing Finance Director Services or Opportunities

If you are looking to access the services of a finance director (for example, as a business owner or municipal leader), consider these approaches:

- Contact reputable executive search firms with experience in finance placements.

- Consult professional networks or industry associations for referrals to qualified candidates.

- If you are a public sector entity, reach out to your state’s municipal finance association or visit your official state government’s website to find guidance on hiring finance professionals.

For individuals seeking to become a finance director, you can:

- Explore job postings on established job boards using search terms like “finance director” and tailor your application to highlight leadership and compliance experience.

- Connect with professionals on LinkedIn or at industry conferences to learn more about organizational needs and hiring practices.

- Consider reaching out to your local chamber of commerce or business council for resources on executive career development.

Key Takeaways

The finance director is an influential leader responsible for shaping and safeguarding an organization’s financial future. Whether you are aiming to hire, work with, or become a finance director, understanding the depth and breadth of this role is essential. For personalized guidance, consider contacting reputable executive recruiters, consulting your professional network, or searching official organizational websites for up-to-date postings and resources.

References

MORE FROM jobsmatch4u.com