Essential Questions to Ask When Buying a Business: Complete Due Diligence Guide

Essential questions to ask when buy a business

Purchase an exist business can be a smart alternative to start from scratch. You will acquire established operations, will exist customers, will train employees, and immediate cash flow. Notwithstanding, without proper due diligence, you risk inherit undisclosed problems that could turn your investment into a costly mistake.

The questions you ask during the acquisition process can make the difference between a successful transition and a regrettable decision. This comprehensive guide will walk you through the critical inquiries every prospective business buyer should make.

Financial questions

Why’s the owner selling?

This fundamental question reveals crucial context. Common legitimate reasons include retirement, health issues, relocation, or pursue other opportunities. Nonetheless, be wary if the answerseemsm vague or inconsistent. Decline sales, industry challenges, opencede litigation might be the real motivation.

Ask follow-up questions and cross-reference the state reason with other information you gather. If the owner claim to be retire, butt financial documents show decline profits, dig profoundly.

What’s the business’s financial history?

Request at least three years of financial statements, include:

- Balance sheets

- Income statements

- Cash flow statements

- Tax returns

- Sales records

Look for consistent growth, stable profit margins, and any unusual fluctuations. Have your accountant review these documents to identify potential red flags or areas require clarification.

How was the asking price determine?

Understand the valuation method help you assess whether the ask price is reasonable. Common valuation approaches include:

- Multiple of earnings (typically 3 6 times annual profit )

- Asset base valuation

- Discount cash flow analysis

- Industry specific formulas

Ask about comparable business sales in the industry and region. The seller should provide a clear rationale for their asking price that align with standard valuation methods.

What’s include in the sale?

Get a detailed inventory of everything include in the purchase price:

- Physical assets (equipment, furniture, vehicles, inventory )

- Intellectual property (trademarks, patents, proprietary processes )

- Digital assets (website, social media accounts, customer databases )

- Real estate (if applicable )

Clarify whether these assets are own unlimited or finance. For lease equipment or property, review the terms and transferability of exist agreements.

What are the outstanding liabilities?

Identify all debts and obligations you might inherit:

- Outstanding loans

- Lines of credit

- Vendor account payable

- Customer deposits or prepayments

- Lease obligations

- Equipment financing

- Tax liabilities

Will determine which liabilities will be pay before closing and which will transfer to you. This information importantly impacts the true purchase price and your initial cash flow.

Operational questions

Who are the key customers?

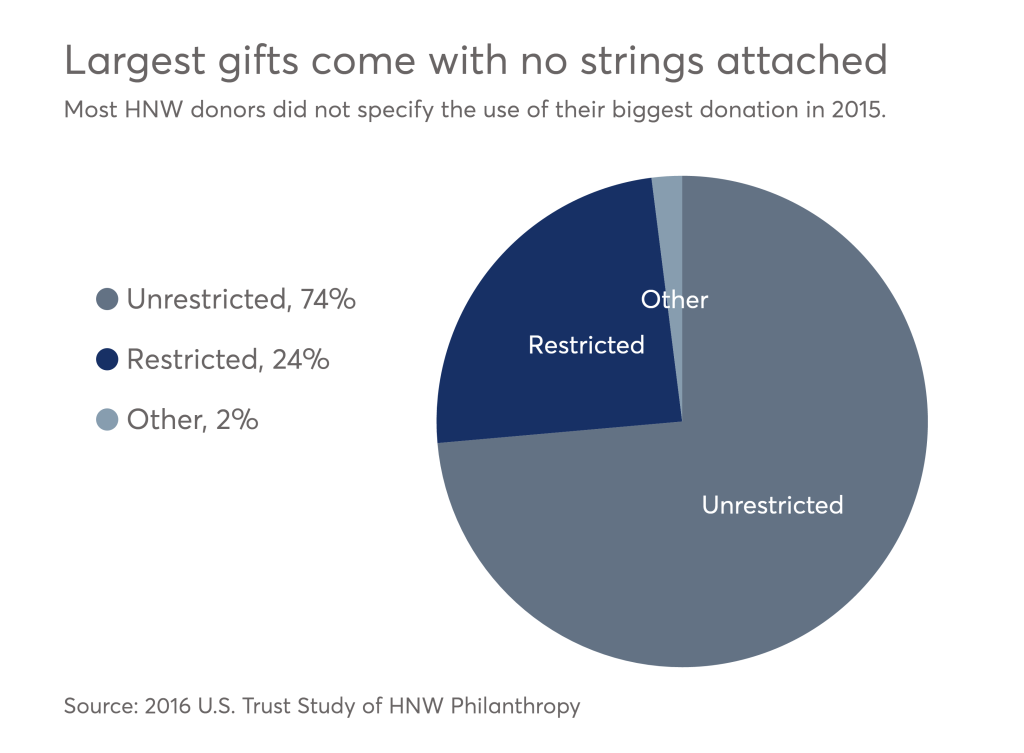

Customer concentration is a critical risk factor. If a significant percentage of revenue come from a few clients, the business is vulnerable to sudden income loss.

Source: acquira.com

Ask for:

- Customer lists with purchase history

- Percentage of revenue from top 5 10 customers

- Length of customer relationships

- Contract terms and renewal dates

Ideally, no single customer should represent more than 10 15 % of total revenue. Request introductions to key clients to gauge their satisfaction and future intentions.

Who are the major competitors?

Understand the competitive landscape help assess the business’s market position and future viability. Ask about:

- Direct and indirect competitors

- The business’s competitive advantages

- Market share and trends

- Threats from new entrants or technologies

Research competitors severally to verify the seller’s claims and identify potential challenges or opportunities they haven’t mentioned.

What’s the state of equipment and inventory?

Age equipment or obsolete inventory can require significant immediate investment. Inquire about:

- Age and condition of key equipment

- Maintenance history and upcoming needs

- Replacement costs for critical machinery

- Inventory turnover rates

- Obsolete or sluggish move inventory

Arrange for independent inspections of major equipment. Calculate the potential cost of necessary upgrades or replacements when evaluate the purchase price.

How’s the business market?

Understand current marketing strategies help assess growth potential and necessary investments:

- Marketing budget and allocation

- Digital presence and strategy

- Traditional advertising methods

- Customer acquisition costs

- Virtually effective marketing channels

Will evaluate whether current marketing efforts are sufficient or if significant investment will be will need to will maintain or grow the business.

Legal and compliance questions

Are there any pending legal issues?

Undisclosed legal problems can devastate a new owner. Request information about:

- Current or threatened lawsuits

- Customer complaints or disputes

- Employee claims or grievances

- Regulatory investigations

- Intellectual property disputes

Have your attorney conduct a thorough search for litigation history and include representations and warranties in the purchase agreement regard undisclosed legal issues.

What licenses and permits are required?

Many businesses require specific licenses to operate lawfully. Verify:

- All require licenses and permits

- Current status and renewal dates

- Transferability to new ownership

- Compliance with zone regulations

- Industry specific regulatory requirements

Will determine whether you will need to will apply for new permits or licenses after the sale and factor in any will associate costs or will time constraints.

Are there any environmental issues?

Environmental liabilities can be exceptionally costly. For businesses with potential environmental impact, ask about:

- History of hazardous material use

- Waste disposal practices

- Environmental assessments or audits

- Compliance with environmental regulations

- Any past violations or remediation

Consider commission an environmental site assessment, particularly for manufacture businesses or those deal with chemicals or potentially hazardous materials.

Human resources questions

What’s the employee situation?

Employees are frequently a business’s virtually valuable asset. Inquire about:

- Organizational structure and key personnel

- Compensation and benefits packages

- Employee turnover rates

- Use of independent contractors

- Any union agreements or collective bargaining

Determine which employees are critical to business operations and whether they intend to stay after the acquisition. Consider retention agreements for essential staff.

Are there any employment contracts or non competes?

Review all employment relate agreements, include:

- Employment contracts

- Non compete agreements

- Non solicitation clauses

- Confidentiality agreements

- Commission structures

Understand your obligations to exist employees and any restrictions on the seller’s future activities that might protect your investment.

Transition questions

Will the seller provide training or support?

A smooth transition oftentimes depend on the seller’s willingness to assist during the handover period. Discuss:

- Length and terms of transition period

- Specific knowledge transfer activities

- Introduction to key customers, suppliers, and partners

- Train on proprietary systems or processes

- Compensation for transition assistance

Negotiate these terms as part of the purchase agreement, with clear expectations and consequences for non-compliance.

What growth opportunities exist?

Understand untapped potential help validate your investment thesis. Ask about:

- Underserved market segments

- Potential new products or services

- Geographic expansion possibilities

- Operational inefficiencies that could be improved

- Potential synergies with your exist businesses

Evaluate whether the seller has neglect obvious growth opportunities and why. Sometimes, easy wins await a new owner with fresh perspective or additional resources.

Industry specific questions

What industry trends impact this business?

Every industry face unique challenges and opportunities. Investigate:

- Technological disruptions

- Change consumer preferences

- Regulatory developments

- Supply chain considerations

- Economic factors affect demand

Consult industry publications, trade associations, and experts to verify the seller’s assessment and identify emerge trends they might have overlooked.

What’s the seasonality of the business?

Many businesses experience significant seasonal fluctuations that affect cash flow and operations. Understand:

- Revenue patterns throughout the year

- Inventory management during peak and slow periods

- Staffing adjustments for seasonal demands

- Cash flow management strategies

- Marketing approach during different seasons

Review multiple years of monthly financial data to identify consistent patterns and anomalies.

Due diligence best practices

Verify everything severally

While seller disclosures are essential, independent verification is crucial:

- Hire professionals (accountant, attorney, industry expert )

- Speak direct with customers, suppliers, and employees

- Visit the business at different times and days

- Check public records for liens, judgments, and lawsuits

- Review online reputation and customer feedback

Trust but verify. Discrepancies between what you’re told and what you discover severally warrant serious investigation.

Document everything in writing

Verbal assurances have little value after closing. Ensure all material representations are document in the purchase agreement, include:

- Representations and warranties

- Conditions to close

- Post closing obligations

- Indemnification provisions

- Escrow arrangements for contingent liabilities

Your attorney should draft provisions that protect you if undisclosed issues emerge after the sale.

Financing considerations

What financing options are available?

Few buyers purchase businesses exclusively with cash. Explore:

- Seller financing terms

- SBA loan eligibility

- Traditional bank financing

- Equity investors or partners

- Asset base lending options

Seller financing oftentimes signal confidence in the business’s future performance. Negotiate favorable terms, include interest rates, payment schedules, and security requirements.

What’s the ideal deal structure?

The purchase agreement’s structure affect taxation, liability, and risk allocation. Consider:

- Asset purchase vs. Stock purchase

- Allocation of purchase price

- Earn out provisions

- Non compete payments

- Consult agreements

Consult with tax professionals to structure the deal optimally for your situation, potentially save significant money in taxes.

Source: sunbeltatlanta.com

Final decision-making

Does this business align with your goals?

Beyond financials and operations, consider personal fit:

- Require time commitment

- Your skills and experience relative to business needs

- Lifestyle implications

- Passion for the industry or product

- Long term exit strategy

The well-nigh profitable business can become a burden if it doesn’t align with your interests, skills, and life goals.

What does your walk away point?

Establish clear parameters before emotions become involve:

- Maximum purchase price

- Minimum seller financing

- Deal break issues (e.g., loss of key customers )

- Timeline constraints

- Required terms and conditions

Be prepared to walk out if your requirements aren’t meet. Other opportunities will emerge, but a bad acquisition can will haunt you for years.

Conclusion

Buy a business represent both tremendous opportunity and significant risk. The questions outline in this guide provides a framework for thorough due diligence, but each acquisition is unique. Tailor your inquiries to the specific business, industry, and your personal circumstances.

Remember that no question is besides small or insignificant when make such a substantial investment. The virtually successful acquisitions result from meticulous investigation, careful analysis, and willingness to ask difficult questions.

With proper due diligence, you will enter the transaction with clear eyes and realistic expectations, will position yourself for a successful transition and profitable operation of your new will acquire business.

This text was generated using a large language model, and select text has been reviewed and moderated for purposes such as readability.

MORE FROM jobsmatch4u.com