Business Startup Essentials: Storage Units, LLCs, Licenses, and Lawn Care Regulations Explained

Using a Storage Unit for Your Business: What’s Possible and What’s Not

Entrepreneurs often seek affordable alternatives to traditional commercial spaces when launching a new business. Self-storage units present a tempting option, especially due to their cost-effectiveness, flexibility, and convenience. However, legal and practical restrictions apply to their use for business purposes.

Operating a business directly out of a storage unit is generally not permitted . Most self-storage facilities have strict lease agreements prohibiting commercial activities, including customer visits or sales transactions on the premises. Zoning laws typically restrict storage units to warehousing or personal storage, not retail, manufacturing, or office use. Running a retail operation or any business that generates regular foot traffic from a storage unit may violate zoning ordinances, potentially resulting in fines or forced closure [1] , [2] .

Despite these limitations, many entrepreneurs successfully use storage units to support their businesses. This includes storing inventory, equipment, supplies, or documents. For example, e-commerce operations, event planners, or seasonal businesses may benefit from using storage units as overflow or off-season storage, freeing up space at home or in primary offices [3] , [4] .

Step-by-step guidance for using a storage unit:

- Check your local zoning laws and speak with your municipality’s zoning office to confirm permitted uses in your area.

- Review the self-storage facility’s lease agreement and policies. Most ban customer-facing business operations but may allow inventory storage.

- Use the unit strictly for storage and logistical support, not for conducting business meetings or transactions.

- If your business requires public access, seek a property zoned for commercial use.

- Consider climate-controlled units for sensitive inventory such as fabrics or electronics.

Key takeaway: Storage units can be a valuable resource for inventory and supply management, but not as storefronts or customer service locations. Always verify local laws and facility policies before proceeding.

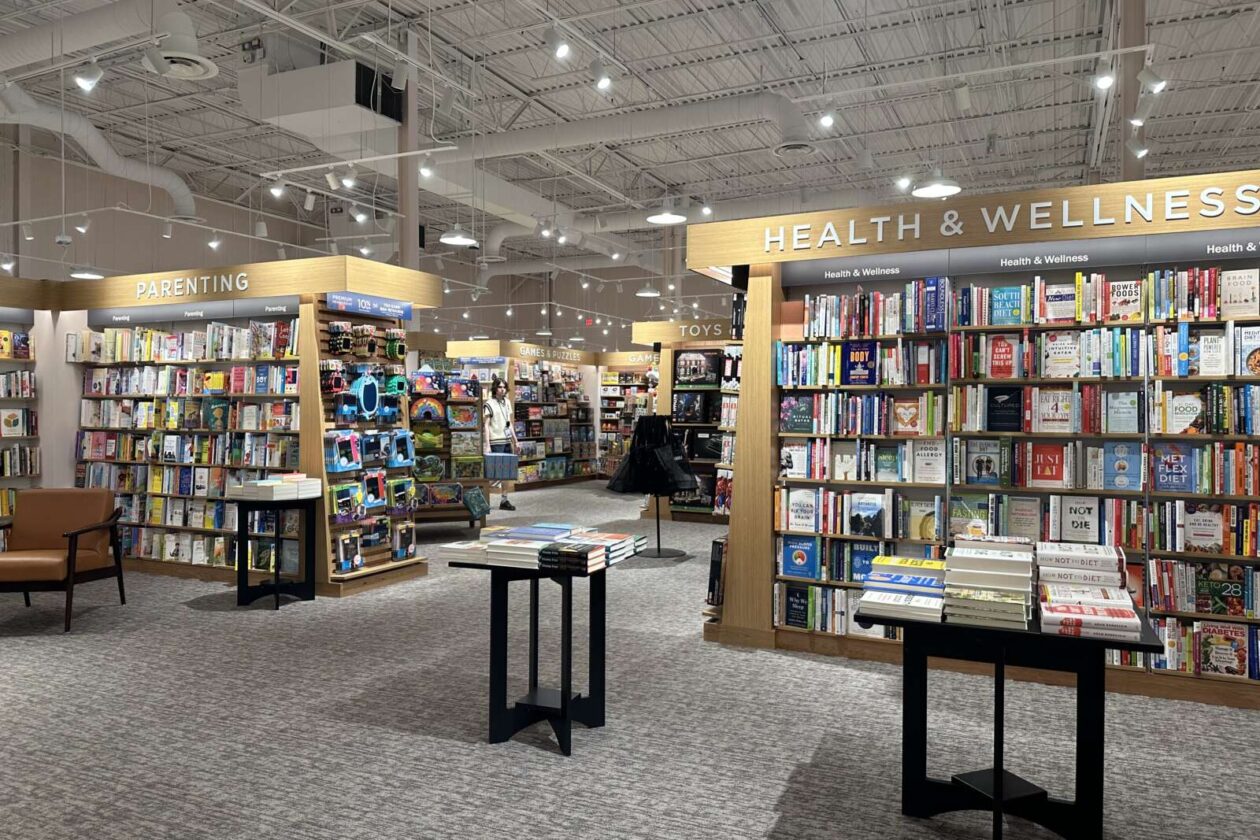

LLCs and Business Licenses: What You Need to Know

Launching a business often involves forming a Limited Liability Company (LLC) for liability protection and credibility. Many ask whether an LLC can exist without a business license.

You can form an LLC without having a business license . The process of creating an LLC is separate from licensing; forming an LLC typically involves filing articles of organization with your state’s Secretary of State and paying a formation fee. However, operating your business legally may require additional licenses or permits, depending on your location and industry .

For example, some states or municipalities require business licenses for all businesses, while others only require them for certain activities (retail, food service, professional services, etc.). Failing to obtain required licenses can lead to fines, denial of your ability to operate, or even dissolution of your LLC.

Source: dreamstime.com

How to form an LLC and determine licensing needs:

- Visit your state’s Secretary of State website for LLC formation forms and instructions (search “[Your State] Secretary of State LLC formation”).

- Check your city and county government websites for business licensing requirements.

- Consult the U.S. Small Business Administration (SBA) guide for an overview of common licenses and permits by industry and location.

- Contact local agencies directly if you’re unsure which licenses apply to your business model.

Key takeaway: Forming an LLC is only the first step. Ensure compliance by researching and obtaining all necessary business licenses and permits.

Business License Costs: What to Expect

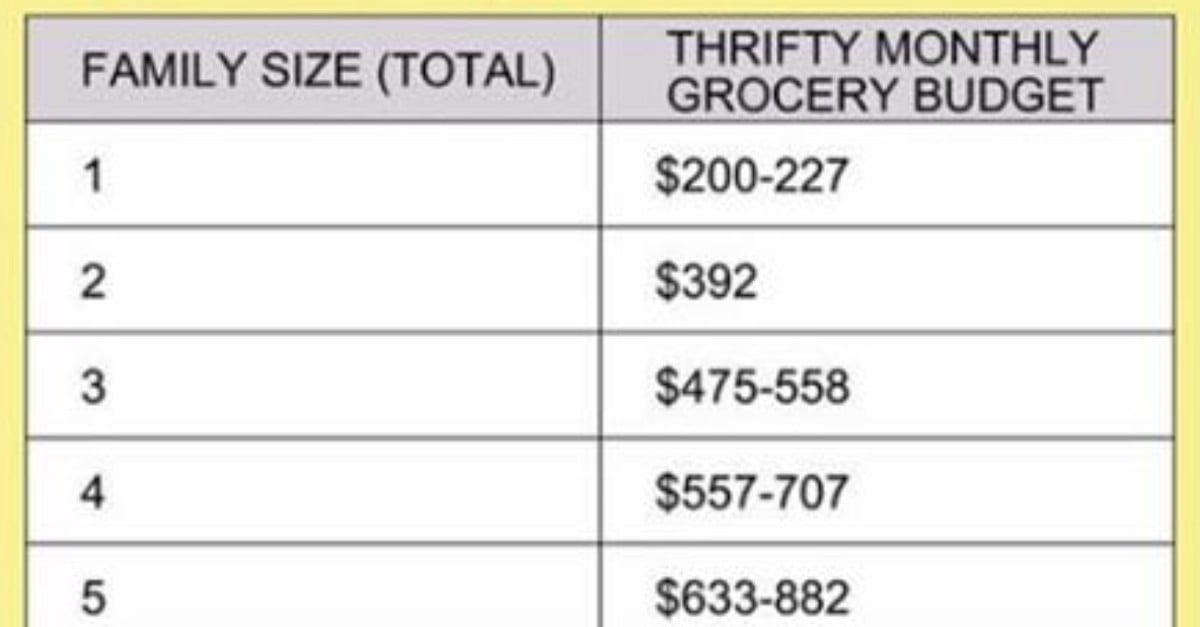

Business license costs vary widely by state, city, and business type. There is no universal fee; instead, you’ll encounter a range of prices depending on your local government and the nature of your business.

In many cities, basic business licenses cost between $50 and $400 per year, but fees can be higher for specialty businesses, such as those selling alcohol or operating in regulated industries. Additionally, some municipalities charge an initial application fee plus annual renewals .

Other factors influencing cost include:

- Business location (some states and cities charge more than others)

- Type of business activity (retail, service, manufacturing, etc.)

- Number of employees

- Gross receipts or revenue

To determine the cost for your specific business:

- Search for your city or county’s business license office (e.g., “[Your City] business license application”).

- Review fee schedules and application forms listed on official local government websites.

- Contact the office directly for fee confirmation if you cannot find detailed information online.

Example: The City of Los Angeles charges $91 for its basic business tax registration, while New York City’s general business license fee is $25, but additional fees may apply for certain industries.

Key takeaway: Always verify costs with your local government office, as fees change regularly and may depend on your business structure and operations.

Do You Need a License for a Lawn Care Business?

Starting a lawn care business can be a lucrative opportunity, but licensing requirements vary by state and municipality. In general, most local governments require a business license for lawn care services, especially if you operate as a formal business entity (LLC, corporation, etc.) .

Additional permits may be required if your services include applications of fertilizers or pesticides. These activities are often regulated by state departments of agriculture and may necessitate special certification or licensing.

Steps to launch a lawn care business legally:

- Form your business entity (LLC, sole proprietorship, etc.) through your state’s official registration process.

- Apply for a local business license through your city or county government.

- If you plan to apply pesticides or fertilizers, contact your state’s Department of Agriculture for certification requirements and testing procedures.

- Obtain liability insurance to protect your business and clients.

- Keep records of all chemical applications and comply with EPA guidelines for safety and environmental protection.

Alternative approaches:

- If you operate as a sole proprietor for small-scale or residential services, some municipalities may have relaxed requirements. Always confirm with your local government office.

- For side businesses or part-time operations, you may still need a license if you advertise publicly or collect payment for services.

- Joining a professional association, such as the National Association of Landscape Professionals, can provide resources and guidance for compliance and best practices.

Key takeaway: Most lawn care businesses require a business license, and chemical application typically requires additional permits.

Potential Challenges and Solutions

Many entrepreneurs encounter confusion or delays when trying to understand local regulations. Here are common challenges and practical solutions:

- Challenge: Unclear requirements or conflicting information online. Solution: Contact your city or county clerk’s office directly for up-to-date regulations and application forms.

- Challenge: Complex licensing for multi-service businesses. Solution: Consult legal or business advisors specializing in local compliance, or use resources from the U.S. SBA .

- Challenge: Delays due to missing documents. Solution: Prepare all required paperwork (proof of identity, business formation documents, insurance certificates) before submitting your application.

Summary of Key Steps for Small Business Success

Launching and managing a business involves navigating legal, practical, and regulatory hurdles. Whether you are considering using a storage unit for inventory, forming an LLC, estimating licensing costs, or starting a lawn care business, take the following steps:

- Verify local zoning laws and facility policies before using a storage unit for business purposes.

- Form your business entity and research all required licenses and permits by consulting official government sources.

- Estimate licensing costs by checking your city or county’s business license office for current fee schedules.

- For specialized services like lawn care, confirm additional certification requirements with your state’s Department of Agriculture.

- Contact local offices directly for guidance, and consult the U.S. SBA for comprehensive resources.

Following these steps helps you stay compliant, avoid costly mistakes, and position your business for sustainable growth.

Source: juniorsilveira.com.br

References

- Storage Post (2025). Can You Run a Business from a Self-Storage Unit?

- Mouser Self Storage (2025). Legal Issues for Hobby Shops in Self-Storage Units.

- urBin Storage (2025). Can You Run a Business Out Of a Storage Unit?

- Firefighting’s Finest Moving & Storage (2023). Running a Business out of a Storage Unit in Texas.

- U.S. Small Business Administration (2025). Apply for Licenses and Permits.

MORE FROM jobsmatch4u.com